Both Apple and Samsung ended 2025 on a positive note in Europe, but 2026 is not looking good

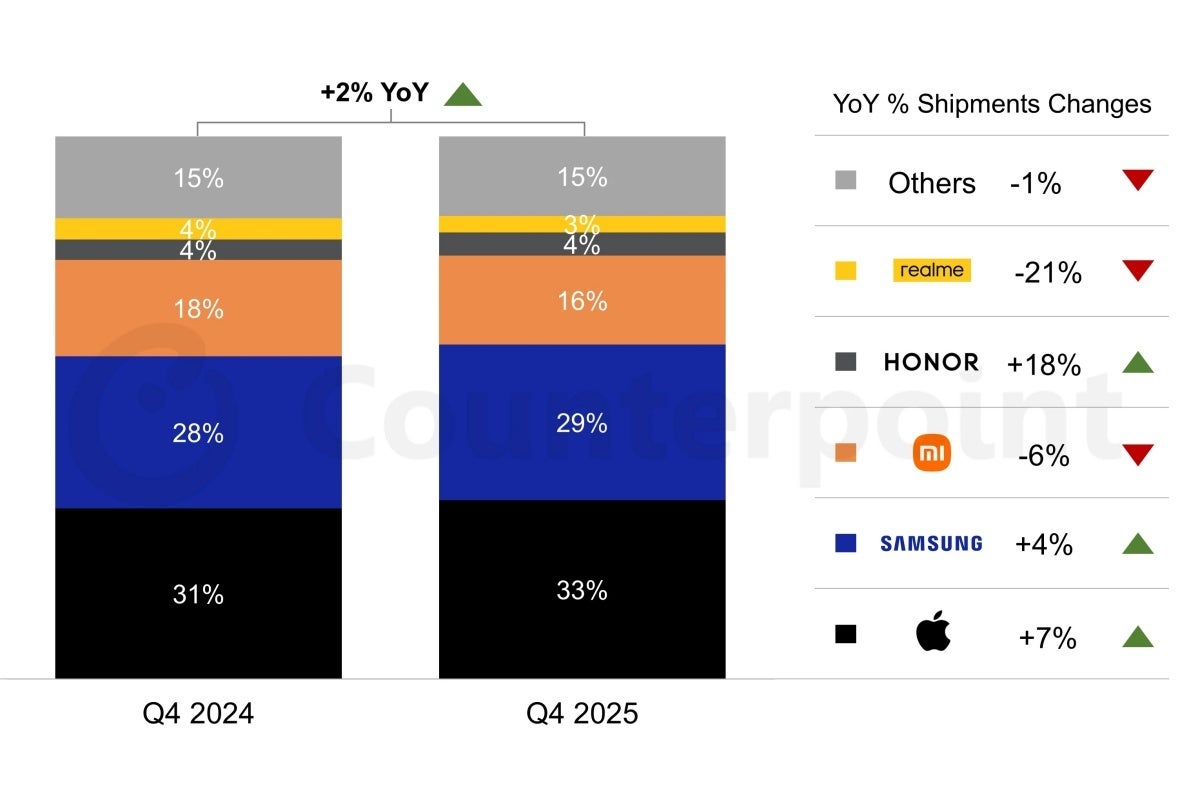

The European smartphone market as a whole expanded by 2 percent in Q4 2025 before a significant predicted decline this year.

Both the iPhone 17 and Samsung Galaxy S25 apparently generated strong demand in Europe in 2025. | Image by PhoneArena

Apple's lead over Samsung is growing here too

That's right, iPhones are dominant in Europe in addition to the US or China, and while Apple's advantage over its arch-rival in this particular region isn't exactly massive, the gap between the top two vendors has expanded from 3 percent in Q4 2024 to 4 percent in Q4 2025.

Apple is starting to look harder and harder to beat in Europe too. | Image by Counterpoint Research

Perhaps more impressively, Apple shipped exactly one in three smartphones in Europe between October and December 2025, boosting its regional numbers by a solid 7 percent compared to the last 90 days of the previous year.

In second place, Samsung also managed to (slightly) improve both its sales figures and market share, while bronze medalist Xiaomi was unable to do that, losing 2 percent in share and 6 percent in shipments compared to Q4 2024.

What's your favorite smartphone brand?

But there's actually no brand that can realistically hope to climb on the European podium anytime soon, as Honor and Realme continue to hold microscopic market shares in fourth and fifth place, respectively, and the likes of Motorola and Google remain unable to convert their steady "expansions across the region" into impressive enough shipment figures to crack the top five.

Apple's secret to success is... no secret

There are no prizes for guessing what devices were behind Apple's Q4 growth in Europe, as they're unsurprisingly the same ones that drove the tech giant's latest sales improvements everywhere else too.

I'm talking, of course, about the iPhone 17 family, which generated "robust" enough demand on the old continent to help the market grow by 2 percent from Q4 2024. Interestingly, Counterpoint Research doesn't name any names of Samsung or Honor devices that may have produced the latest progress of those two brands, which leads me to assume that it was the broader product portfolios of the two that proved successful in Q4 2025 rather than any individual model or handset family.

The iPhone 17 family struck gold at the European box-office in the final three months of 2025. | Image by PhoneArena

But the iPhone 17 series and the product lineups of the region's top Android vendors are unlikely to prove popular enough this year to offset the rising memory prices, which are expected to make virtually all new devices more expensive and/or less appealing than their forerunners.

As such, a "significant downturn" is predicted in the European smartphone market in 2026, although Counterpoint isn't ready to try to forecast how bad this decline will be, which sounds gloomy in and of itself.

Can Apple and Samsung find the road to more growth this year?

That seems highly unlikely due to that very obvious reason mentioned above, but if the iPhone 18 Pro and 18 Pro Max do end up keeping the price points of their predecessors unchanged, Apple can certainly expect another strong Q4 sales result in 2026.

Of course, the absence of a "vanilla" iPhone 18 model this year might prove problematic in countries that are a little more focused on affordability than the US, as will the Galaxy S26 family's widely rumored price hikes over the S25 series for Samsung.

Europe is typically especially welcoming of Galaxy A-series mid-rangers, mind you, so another important product for the region's number two vendor could be the impending Galaxy A57, which... doesn't look great on paper either.

Follow us on Google News

Things that are NOT allowed:

To help keep our community safe and free from spam, we apply temporary limits to newly created accounts: